Critical Do's and Don'ts During the Mortgage Loan Process

Critical Do's and Don'ts During the Mortgage Loan Process

Essential Guidelines to Protect Your Loan Approval from Pre-Approval to Closing Day

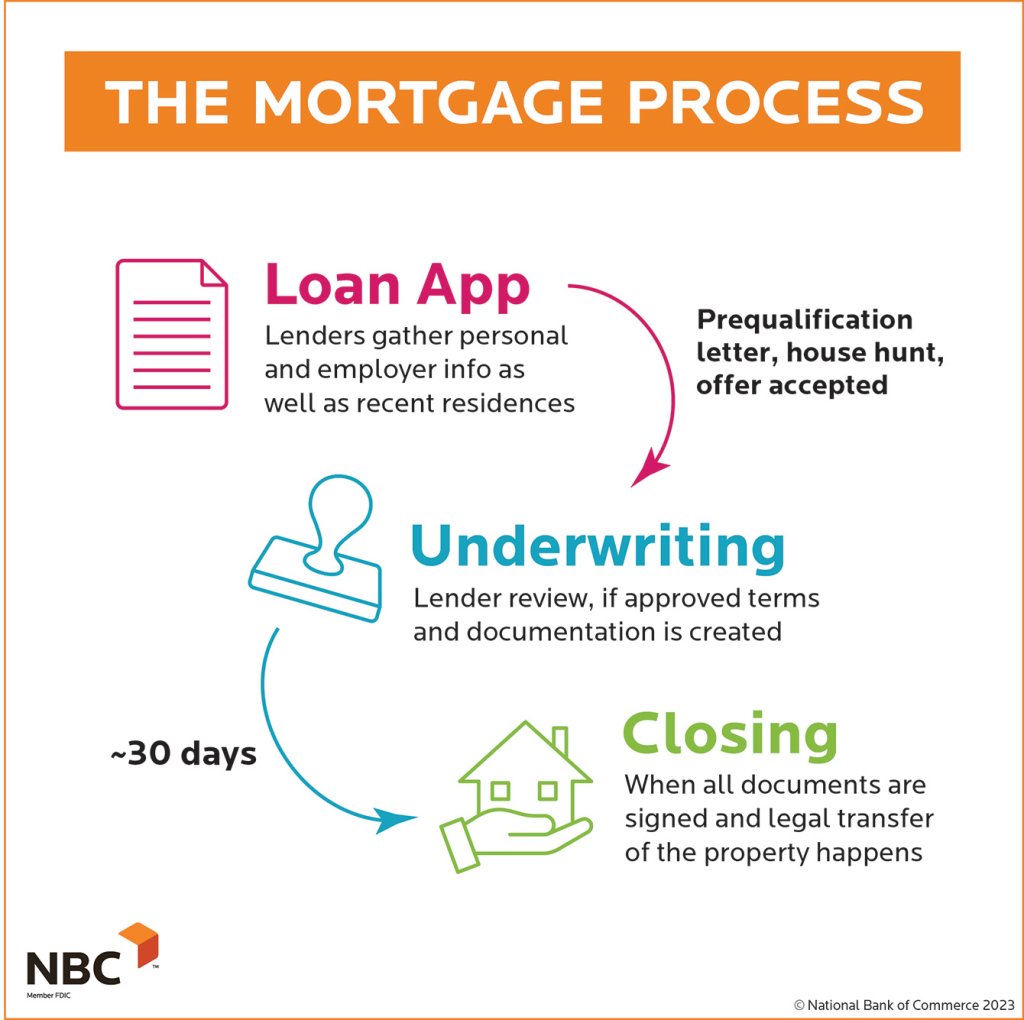

⚡ Important: The mortgage approval process doesn't end when you're pre-approved or even when your offer is accepted. Lenders continue to monitor your financial situation right up until closing day—and sometimes even on closing day itself! One seemingly innocent financial move could delay your closing or even cause your loan to be denied.

This guide will help you navigate the critical period from application to closing without jeopardizing your loan approval.

🎯 Quick Reference: The Golden Rule

FREEZE YOUR FINANCIAL SITUATION

From the moment you apply for a mortgage until the day you close, maintain the status quo. Any change—no matter how small or well-intentioned—could impact your approval.

DON'Ts - Avoid These at All Costs

Don't Apply for New Credit CRITICAL

This includes credit cards, car loans, personal loans, student loans, store credit cards, or even responding to credit card offers.

Don't Make Major Purchases CRITICAL

Avoid buying cars, boats, RVs, motorcycles, expensive jewelry, furniture, appliances, or any big-ticket items—even if you pay cash.

Don't Change Jobs or Quit CRITICAL

Stay in your current position throughout the entire loan process, even if offered a better opportunity.

Don't Close Credit Card Accounts HIGH IMPACT

Even if you never use a credit card, keep it open during the loan process.

Don't Pay Off Collections (Usually) HIGH IMPACT

Unless specifically requested by your lender, don't pay off old collection accounts.

Don't Max Out Credit Cards CRITICAL

Keep credit card balances below 30% of the available limit, ideally below 10%.

Don't Make Large or Unusual Deposits HIGH IMPACT

Avoid depositing large sums of cash or receiving large transfers that aren't regular paychecks.

Don't Transfer Money Between Accounts MEDIUM IMPACT

Keep your money where it is. Avoid moving funds between checking, savings, or investment accounts.

Don't Switch Banks MEDIUM IMPACT

Wait until after closing to open new bank accounts or move your banking relationship.

Don't Co-Sign Loans for Others HIGH IMPACT

Helping family or friends with their credit will hurt yours during this period.

Don't Miss or Make Late Payments CRITICAL

Pay all bills on time: mortgage/rent, car loans, credit cards, utilities, student loans, child support—everything.

Don't Consolidate Debt MEDIUM IMPACT

Resist the urge to consolidate credit cards or refinance other debts during the mortgage process.

Don't Freeze Your Credit Reports HIGH IMPACT

If you have security freezes in place, don't add new ones, and be ready to lift existing ones.

Don't Change Your Spending Patterns MEDIUM IMPACT

Maintain your normal spending habits on credit cards and bank accounts.

Don't Ignore Lender Communications CRITICAL

Respond immediately to all emails, calls, and document requests from your lender.

DO's - Follow These Guidelines

Do Make All Payments On Time

Set up automatic payments if possible to ensure nothing is missed.

Do Keep All Accounts Current

Maintain every financial obligation you have: loans, credit cards, phone bills, subscriptions.

Do Use Credit Cards Normally

If you typically use credit cards for daily expenses, continue. If you rarely use them, keep it that way.

Do Keep Your Job

Stay in your current position, even if you receive a better offer. Wait until after closing.

Do Maintain Adequate Cash Reserves

Keep enough money in your accounts to cover down payment, closing costs, and reserves.

Do Communicate with Your Lender

Before making ANY financial decision, ask your lender if it's safe. When in doubt, ask.

Do Respond Promptly to Document Requests

Provide requested documents within 24 hours whenever possible.

Do Provide Complete and Accurate Information

Be thorough and honest on all applications and documentation.

Do Keep Paper Trails for Everything

Save receipts, statements, and documentation for all financial transactions.

Do Set Up Credit Monitoring

Use your bank's free credit monitoring or a service to alert you to changes.

Do Continue Living Below Your Means

Practice financial restraint and avoid unnecessary expenses during this period.

Do Inform Your Lender of Life Changes

Getting married, having a baby, legal name changes—tell your lender immediately.

Do Keep Documentation Organized

Create a file (physical or digital) with all loan-related documents in one place.

Do Read Everything Carefully

Review all documents, emails, and disclosures thoroughly before signing or responding.

Do Maintain Your Current Living Situation

If renting, keep your lease. If living with family, stay put. Don't move until after closing.

⏰ When These Rules Apply: From Application to Closing

Critical Time Periods

- Pre-Approval Phase: Rules apply from the moment you submit your first loan application. Changes here affect your pre-approval amount and rate.

- Home Shopping Phase: Continue following all rules. Your finances must match your pre-approval when you make an offer.

- Under Contract: MOST CRITICAL PERIOD. One mistake here can cost you your dream home and earnest money deposit.

- During Underwriting: Zero tolerance for changes. Underwriters scrutinize every detail of your financial life.

- Before Closing: Lenders pull credit again days before closing. Late payments or new debt discovered here mean immediate denial.

- Closing Day: Some lenders verify employment on closing day. Don't quit your job until AFTER you have the keys!

🎯 Key Takeaways: What You Need to Remember

- Freeze Frame Your Finances: Imagine your financial life is paused from application to closing. No changes = no problems.

- Credit Score is King: Every action affecting your credit score can impact your loan approval and interest rate. Protect it fiercely.

- Debt-to-Income Ratio Matters: New debt or reduced income changes your DTI, which can disqualify you from your approved loan amount.

- Paper Trail is Everything: Every dollar must be documented and explained. Unexplained funds equal denied loans.

- When in Doubt, Ask: Your lender would rather answer 100 questions than deny your loan. There are no stupid questions.

- Lenders Verify Multiple Times: Don't think "they already approved me." Lenders check employment, credit, and assets repeatedly until closing.

- Even Cash Purchases Matter: Paying cash for a car depletes reserves lenders need you to maintain. How you spend matters as much as debt.

- Patience Pays Off: Wait a few weeks for major purchases. Don't sacrifice your home for furniture or a new car.

Common Myths That Can Cost You

- Myth: "I'm already pre-approved, so I can relax."

Reality: Pre-approval is conditional. Lenders verify everything again before closing. - Myth: "Paying off debt improves my chances."

Reality: Paying off collections often lowers your credit score. Ask your lender first. - Myth: "Closing unused credit cards will help."

Reality: Closing accounts typically drops your credit score by reducing available credit. - Myth: "Cash purchases don't affect my loan."

Reality: Large cash purchases deplete reserves lenders require you to maintain. - Myth: "If I don't tell them, they won't know."

Reality: Lenders pull credit multiple times and verify employment through closing day. They WILL find out. - Myth: "Small purchases won't matter."

Reality: Even financing a $2,000 appliance increases your DTI and could disqualify you.

What If Something Unavoidable Happens?

Life doesn't stop during your mortgage process. If something unavoidable occurs:

- Call Your Lender IMMEDIATELY: Before making any decision or signing anything, get guidance from your loan officer.

- Document Everything: Gather all related paperwork and be prepared to provide detailed explanations.

- Be Honest: Attempting to hide changes will result in denial. Transparency gives your lender a chance to work with you.

- Understand Consequences: Some changes may require delaying closing, re-underwriting, or even starting over. Accept this reality.

- Examples of Unavoidable Events: Layoffs, medical emergencies, death in family, identity theft, divorce, disability. These require immediate lender notification.

Your Dream Home is Worth the Wait

The mortgage process typically takes 30-45 days. That's a small sacrifice for achieving homeownership. The new car, furniture, and credit cards will still be available AFTER you close on your home.

When in doubt: DON'T. Ask first.

Your lender is your partner in this process. Use them as a resource. Their job is to get you to the closing table successfully.

This guide is for educational purposes based on common mortgage industry practices. Specific lender requirements may vary. Always consult directly with your lender before making any financial decisions during the mortgage process.

© 2024 Mortgage Loan Process Guide

Share this article

About the Author

Q Home Loans Team is a mortgage loan officer at Q Home Loans, dedicated to helping families achieve their homeownership dreams.

Meet Our Team